September 3, 2025

A Freelancer’s Guide to Invoice Tracking: From Spreadsheet Chaos to Financial Clarity

Does this sound familiar? You’ve finished the project, sent the invoice, and moved on to the next task. A few weeks later, a thought quietly surfaces: “Did that client ever pay?” This question can quickly spiral into a stressful search through emails and bank statements, pulling your focus away from the creative work you love.

For many freelancers, managing finances is a major source of stress. The administrative side of the business can feel chaotic and overwhelming. But what if you could replace that anxiety with a sense of calm and control?

This guide is designed to help you build a simple, reliable invoice tracking system. We’ll walk you through everything from a basic spreadsheet for beginners to the signs that it's time to upgrade to specialized software. Our goal is to provide a clear, step-by-step roadmap that helps you get paid on time, every time, and reclaim your mental energy.

Why an Invoice Tracking System is the Bedrock of Your Freelance Business

Effective invoice tracking is more than just administrative work; it's a fundamental pillar of a healthy freelance business. It empowers you in three critical ways:

Predictable Cash Flow: When you track your invoices, you’re no longer guessing about your income. You have a clear picture of what money is coming in and when. This allows you to plan your business expenses, set financial goals, and operate from a position of stability, not uncertainty.

Enhanced Professionalism: Your clients are running businesses, too. When you send clear, accurate invoices, provide prompt answers to payment queries, and send polite reminders for overdue payments, you signal that you are a serious professional. This builds trust and strengthens client relationships.

Reduced Mental Overhead: One of the biggest hidden costs of poor financial organization is the mental energy it consumes. Constantly trying to remember who owes you money is draining. A reliable system externalizes that burden, freeing up your mind to focus on what truly matters: delivering high-quality work for your clients.

Method 1: The Spreadsheet Solution (Your Starting Point)

For freelancers who are just starting out or managing a small number of clients, a well-organized spreadsheet is a powerful and free tool. It’s simple, transparent, and gives you complete control.

Building Your Master Invoice Tracker: A Step-by-Step Guide

Create a new file in Google Sheets or Microsoft Excel and set up the following columns. These fields represent your "single source of truth" for all client payments.

- Invoice ID: A unique number for each invoice. A simple format like 2025-001, 2025-002 works perfectly. This is crucial for clear communication and record-keeping.

- Client Name: The name of the client or company you are billing.

- Project Description: A brief note about the work completed (e.g., "Website Homepage Design," "5 Blog Articles - May").

- Invoice Date: The date you sent the invoice to the client.

- Amount: The total amount due on the invoice.

- Due Date: The date by which payment is expected (e.g., NET 15, NET 30).

- Status: The current state of the invoice. This is the most important column. Use statuses like

Sent,Paid, andOverdue. - Date Paid: The date you received the payment.

Pro-Tip: Use Conditional Formatting for a Visual Dashboard

Make your "Status" column work for you by adding color codes. In Google Sheets, you can use Format > Conditional formatting to automatically:

- Turn the row green when the status is "Paid."

- Turn the row red when the status is "Overdue."

- Turn the row yellow when the status is "Sent."

This simple trick turns your spreadsheet into a visual dashboard, allowing you to see the health of your finances at a glance.

A Note from Experience: Based on countless stories shared on freelance forums, the most common mistake with spreadsheets is inconsistency. The system only works if you use it religiously. Make it a habit: the moment you send an invoice, add a new row to your tracker. It takes 30 seconds but will save you hours of stress and searching later.

To get you started, we've created a simple Google Sheets template you can copy and use today.

Method 2: Upgrading to Specialized Invoicing Software

As your freelance business grows, the limitations of a spreadsheet may become apparent. Manually creating invoices, sending reminders, and updating statuses can become time-consuming. This is the sign that it's time to graduate to dedicated invoicing software.

When is it Time to Switch?

Consider upgrading if you find yourself:

- Managing more than 5-7 invoices per month.

- Needing to set up recurring invoices for retainer clients.

- Wanting to offer clients the ability to pay online via credit card or PayPal.

- Spending more than an hour each month on invoicing admin.

Key Features to Look For:

- Automated Invoice Creation & Sending: Generate professional invoices from templates.

- Payment Gateway Integration: Connect with Stripe, PayPal, or other gateways.

- Automatic Payment Reminders: Set up polite follow-up emails for overdue payments.

- Reporting & Dashboards: Get a clear overview of your income, expenses, and profitability.

Popular and reputable options for freelancers include Wave (offers a free plan), FreshBooks, and Zoho Invoice.

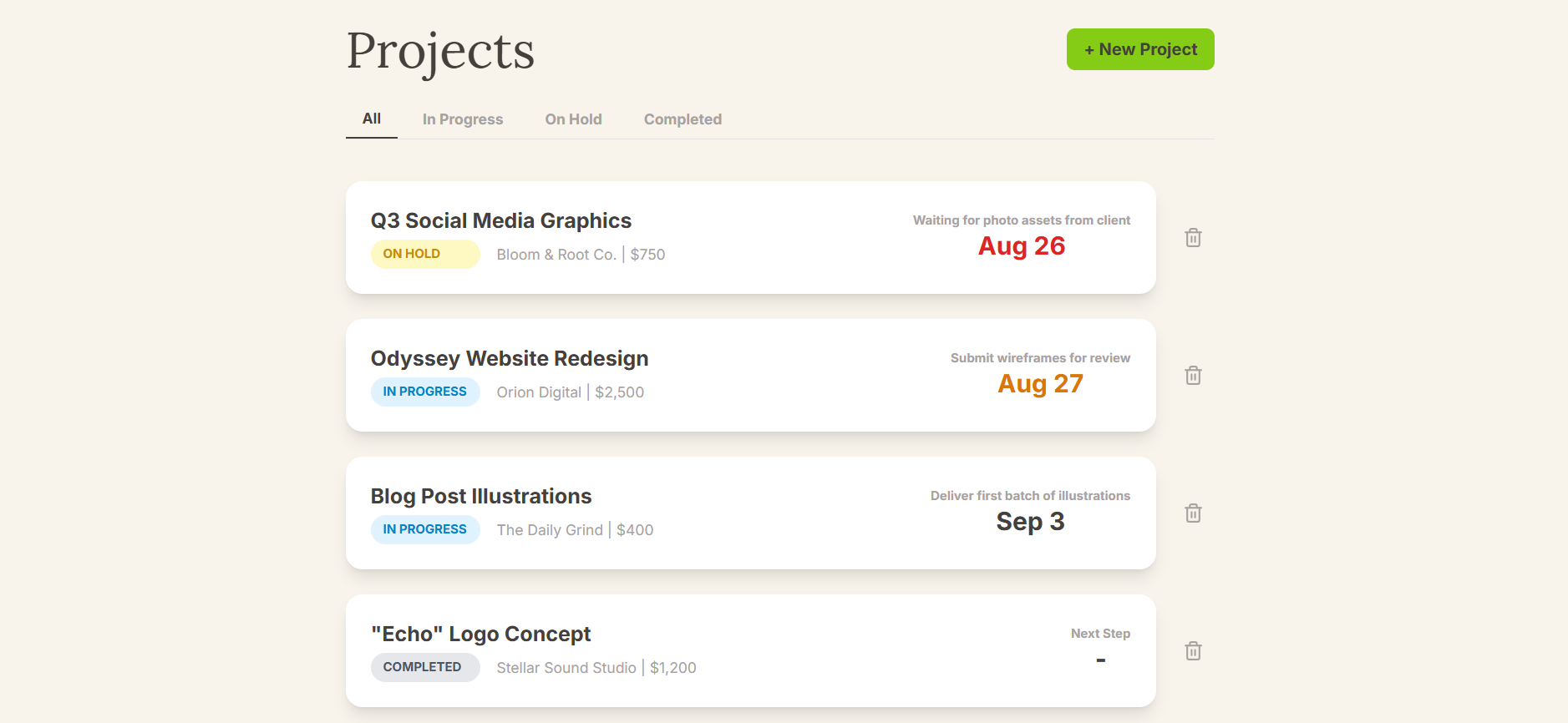

How Jornl Fits Into Your Workflow

It’s important to clarify that Jornl is not an invoicing tool. Instead, it’s designed to perfect the stage before you invoice. Jornl is your calm, organized space to manage projects, track your time, and store client notes and agreements. By keeping your project information tidy and accessible, you ensure that every invoice you create is accurate, justified, and professional. A clean project leads to a clean invoice.

Common Pitfalls in Invoice Management (And How to Avoid Them)

A tool is only as good as the process behind it. Here are three common mistakes that even freelancers with good tools can make.

Pitfall #1: Vague Payment Terms

An invoice that simply says "Payment Due" is an invitation for delays. Your client shouldn't have to guess when or how to pay you.

Solution: Clearly state your payment terms on every invoice. Include the due date (e.g., "Payment due in 15 days on September 20, 2025") and the payment methods you accept.

Pitfall #2: The Fear of Following Up

Reminding a client about an overdue payment can feel awkward. Many freelancers delay this, fearing they will appear rude or pushy. This is a mindset trap. Following up on payments is a normal and necessary business practice.

Solution: Approach it with empathy and professionalism. The client may have simply forgotten, or the invoice might have landed in their spam folder. A polite reminder is often all that's needed. Use a simple, friendly template:

Subject: Gentle Reminder: Invoice #2025-001

Hi [Client Name],

I hope you're having a productive week.

This is just a friendly reminder that invoice #2025-001, for the amount of [$Amount], was due on [Due Date]. I've attached a copy for your convenience.

Please let me know if you have any questions.

Best regards,

[Your Name]

Pitfall #3: No Unique Invoice Numbers

Sending invoices named "Invoice_ClientName.pdf" can create confusion for both you and your client, especially if you work on multiple projects together. It makes tracking and referencing specific payments nearly impossible.

Solution: Implement a simple, sequential numbering system from day one. YEAR-ID (e.g., 2025-001) is a foolproof method that keeps your records clean and easy to navigate for tax season.

Conclusion

Building an effective invoice tracking system is one of the most powerful steps you can take to reduce stress and build a more sustainable freelance business. The specific tool you use is less important than the consistency of your process. Whether you start with a simple spreadsheet or adopt a dedicated software, the key is to create a system you can stick with.

Start today by choosing your method and logging your outstanding invoices. The clarity and peace of mind you'll gain are invaluable. And when it comes to organizing the project work that leads to those invoices, consider giving Jornl a try. It’s the calm, beautiful journal for your freelance life.